Revised 9/29/2010 – I previously titled this blog post, “HP Loses Blade Server Market Share to IBM…” however I have since re-thought that statement. The report from IDC does not specify where HP’s blade server market share went from Q1 2010 – it only provides Q2 2010 market share numbers. I regret any confusion I may have caused.

Original post:

IDC came out with their 2Q 2010 worldwide server market revenue report last month which shows that HP lost blade server market share to IBM.

According to IDC, worldwide server sales (all servers, not just blade servers) for Q2 2010 factory revenues increased 11 % year over year to $10.9 billion in the 2nd quarter of 2010 (1Q10). They also reported the blade server market accelerated and continued its sharp growth in the quarter with factory revenue increasing 30.9% year over year, with shipment growth increasing by 13.6 compared to 2Q09. According to IDC, nearly 80% of all blade revenue is driven by x86 systems, a segment in which blades now represent 18.9% of all x86 server revenue.

While the press release did not provide details of the market share for all of the top 5 blade vendors, they did provide data for the following:

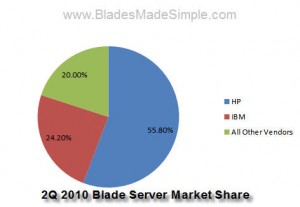

#1 market share: HP decreased their market share from 56.20% in Q1 2010 to 55.8% in Q2 2010

#2 market share: IBM increased their market share from 23.6% in Q1 2010 to 24.2% in Q2 2010.

The remaining 20% of market share was not mentioned, but I imagine they are split between Dell and Cisco.

According to Jed Scaramella, research manager, Enterprise Servers at IDC, “Blade adoption continued to gain momentum in the second quarter of 2010, as blades accounted for its largest portion of total server revenue since the form-factor came to market. Vendors continue to build out their blade offerings through enhanced virtualization, management, and I/O capabilities; customers are leveraging these technologies as part of converged systems that are a building block to future internal cloud infrastructures.”

For the full IDC report covering the Q2 2010 Worldwide Server Market, please click here.

shutterfly coupon codes

free grant money

langerhans cell histiocytosis

gold toe socks

american home patient

Any ideas as to Cisco market share? I keep hearing that they have the #3 spot in the U.S. I am a bit dubious with that claim, unless they are referring to shipments in the last quarter or some other finite time period.

I have not seen any #Cisco blade server market share data from IDC or Gartner. If anyone has that available, I’d welcome it. Thanks for your comment, and thanks for reading!

Pingback: Kevin Houston

Pingback: Alex Yost

Pingback: Jeff Allen

Pingback: Ken Henault

This is not surprising at all given that HP has yet to release anything on the Nehalem-EX platform.. A HUGE miss IMHO

Pingback: Kevin Houston

Pingback: Jeff Allen

We can also glean that the “Other” vendors also lost share, moving from 20.2% to 20.0%.

It’s disappointing the IDC’s report didn’t get a little more detailed about blade servers… but I suppose that wasn’t the purpose of the release. I also found it interesting that of the top 5, just Dell and HP made significant gains in the total server share.

Pingback: Kevin Houston

Pingback: Brian Best

Pingback: Joe Spotswoode

Dell is a distant third in the blade market with 7.6% market, then it drops off dramatically. Sun and Fujitsu both with ~3%, NEC and other region players hold ~1% share each.

Cisco has not officially begun to report server sales to IDC (or Gartner I’m told). They have used IDC as “baseline data” in Chambers’s statements claiming the #3 position; we’ve yet to review the details to the claims, so it’s not clear what Cisco is counting and how it relates to IDC’s taxomony of server sales. (i.e., are there including software in UCS sales, which IDC doesn’t).

We expect to report Cisco server sales in the next few quarters, after the figures have been vetted and accurately equate to IBM and HP’s business.

Jed,

I work for Dell. Not sure where the 7.6% share is coming from for Dell, but that IDC Q2 tracker shows Dell at 11.8% unit share Worldwide (~9% revenue share) in all blades and have gained about 1 point of share each of the last 2 quarters.

The Cisco claims are baffling to us as well.

Mike

Hi Mike.

I was referencing revenue for all blades – x86, RISC, and EPIC. Dell owns 11.8% unit share in x86 blades.

I look forward to checking out those numbers when they’re released. Thanks for the clear explanation.

While not focussed on blades only.. have a peek at the below as it does a great job of analyzing the IDC report…

http://absolutelywindows.com/blog/2010/10/15/correctly-decrypting-the-idc-2q10-server-numbers.html

Pingback: Kevin Houston