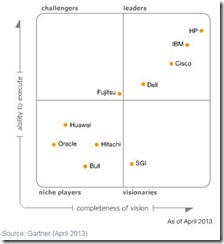

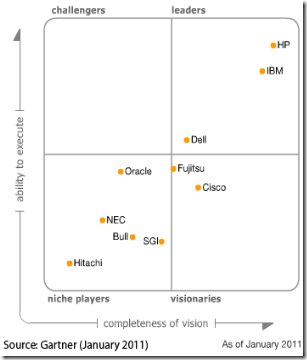

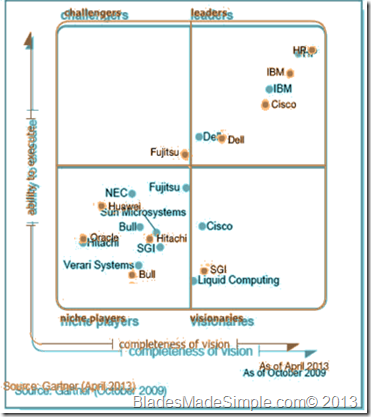

Gartner released the annual Magic Quadrant for blade servers last month and it shows significant changes across the leaderboard within the top 4 leading blade server vendors.

The Magic Quadrant is a tool Gartner uses to visually define a given market segment showcasing technology vendors who are leading the market in 4 areas:

- leaders – vendor placement based on current market share

- visionaries – vendors who, according to Gartner, “will either represent the discontinuous leading edge of the market or will be large vendors with a plan to drive market success through technology innovation and a narrower product portfolio.”

- challengers – defined by Gartner as, “vendors with a strong global presence that are focusing their blade strategies on a broad set of target clients, rather than on pure innovation.”

- niche players – defined by Gartner as vendors who focus on a “market that addresses specialized “edge” niches of the broader server market well, and this will naturally drive innovation by small vendors that may only address certain geographies, vertical markets (such as HPC or cloud infrastructure) or specific workload situations.”

As we review the outcome of Gartner’s Magic Quadrant, we can come to the conclusion that Gartner considers HP the market leader in blade servers with IBM trailing closely behind with Cisco and Dell following at a distant 3rd and 4th position. Gartner reflects that while IBM is close to HP in market share, HP has a better ability to execute.

Gartner’s evaluation criteria definition of ”ability to execute” is rather lengthy, but covers 7 areas:

- Product/Service: Core goods and services offered by the vendor that compete in/serve the defined market.

- Overall Viability (Business Unit, Financial, Strategy, Organization): Viability includes an assessment of the overall organization’s financial health, the financial and practical success of the business unit, and the likelihood that the individual business unit will continue investing in the product, will continue offering the product and will advance the state of the art within the organization’s portfolio of products.

- Sales Execution/Pricing: The vendor’s capabilities in all pre-sales activities and the structure that supports them.

- Market Responsiveness and Track Record: Ability to respond, change direction, be flexible and achieve competitive success as opportunities develop, competitors act, customer needs evolve and market dynamics change.

- Marketing Execution: The clarity, quality, creativity and efficacy of programs designed to deliver the organization’s message to influence the market, promote the brand and business, increase awareness of the products, and establish a positive identification with the product/brand and organization in the minds of buyers.

- Customer Experience: Relationships, products and services/programs that enable clients to be successful with the products evaluated.

- Operations: The ability of the organization to meet its goals and commitments.

Summary of Vendor Strengths and Cautions

Cisco

Strengths

- Global corporation with strong presence in networking

- UCS is an enterprise-class platform with good integration of networking, virtualization and management tools, strengthened by ongoing acquisitions that enhance management capability.

- Vblock and FlexPod are proven fabric-based infrastructure (FBI) solutions that provide Cisco with cross-selling opportunities to partner organizations

- The 2012 acquisition of Cloupia should strengthen Cisco’s management software portfolio.

Cautions

- Cisco’s rack-optimized server market share significantly trails that of the established major vendors which limits its opportunity to be recognized as a leading vendor across the entire server market.

- Cisco’s strategy is dependent on alliances with storage and management tool vendors

- According to Gartner’s report, the perception of Gartner clients is that Cisco and EMC’s close natural partnership appears to be increasingly strained, with both vendors investing in partnerships and acquisitions that compete with the other.

- With no presence in the market for multinode servers, Cisco is exposed to the rapid growth of this sector, which is continuing to take business away from low-end blade servers.

Dell

Strengths

- As a mainstream, x86 server market leader, Dell has extensive cross-selling opportunities to a large and growing installed base that spans all server platforms including multinode, blades, racks and towers.

- The acquisitions of Compellent, Quest Software, Force10 Networks, Gale Technologies and RNA Networks continue to strengthen Dell’s fabric computing message.

- Dell is the clear leader in the rapidly growing market for x86-based multinode extreme scale-out servers.

- Dell has an aggressive pricing policy and a strong midmarket presence.

- Dell has focused innovation in areas such as memory aggregation, general-purpose graphics processing unit (GPGPU) support, cooling and virtual I/O.

Cautions

- While still in the leaders quadrant, Dell has lost blade market share during the past two years, and is now the No. 4 vendor in most geographic markets.

- Despite Dell’s No. 1 or No. 2 position in most x86 market segments, credibility among most enterprise buying centers remains very hard for the vendor to win.

- Dell must achieve messaging around the new Active System branding to fully leverage recent acquisitions and establish a viable FBI presence. Their FBI messaging has been confused by overlapping acquisitions, partnerships and branding policy.

HP

Strengths

- HP’s blade market share is substantially higher than the competition.

- HP has a strong investment in management tools that enable a single point of management across physical and virtual infrastructures (and across blade- and rack-based servers).

- HP offers both blade servers and multinode servers that address market needs.

- The vendor is committed to its proprietary technology such as Virtual Connect and FlexFabric.

Cautions

- HP has made limited progress in 2012 although it has an extensive portfolio of server options.

- While Virtual Connect is well-established on blades, the lack of support for rack-based servers creates operational complexity for users who have both form factors, which inhibits capabilities such as live migration and high availability.

- Positioning of HP’s generic BladeSystem servers alongside competitive designs is a particular challenge, especially because two-thirds of blade server revenue is driven by the channel and it is relatively easy to create an integrated system experience using separate components.

- HP’s Unix revenue has continued to decline through 2012.

IBM

Strengths

- IBM has a very broad set of blade chassis options that address many enterprise requirements.

- The vendor supports x86 and Power-based blades.

- The introduction of a new blade infrastructure, Flex System, should remain viable and strategic for IBM through the decade.

- IBM has the opportunity for highly verticalized platforms (both x86 and RISC) that integrate the hardware and software stack for multiple workloads.

Cautions

- IBM has gradually lost blade server market share over the past three years.

- Fresh speculation about IBM potentially divesting some or all of its x86 server business will create additional concern in the marketplace until the situation is resolved.

To read the full Gartner report, please visit:

http://www.gartner.com/technology/reprints.do?id=1-1FC3J18&ct=130501&st=sb

Past Gartner Magic Quadrants

Here are my previous blog posts on Gartner Magic Quadrants:

https://bladesmadesimple.com/category/gartner-2/

Kevin Houston is the founder and Editor-in-Chief of BladesMadeSimple.com. He has over 15 years of experience in the x86 server marketplace. Since 1997 Kevin has worked at several resellers in the Atlanta area, and has a vast array of competitive x86 server knowledge and certifications as well as an in-depth understanding of VMware and Citrix virtualization. Kevin works for Dell as a Server Sales Engineer covering the Global Enterprise market.

Disclaimer: The views presented in this blog are personal views and may or may not reflect any of the contributors’ employer’s positions. Furthermore, the content is not reviewed, approved or published by any employer.

Pingback: Cisco's Trajectory in Gartner's Magic Quadrant for Blade Servers | M. Sean McGee