IDC reported on February 24, 2010 that blade server sales for Q4 2009 returned to quarterly revenue growth with factory revenues increasing 30.9% in Q4 2009 year over year (vs 1.2% in Q3.) For the first time in 2009 there was an 8.3% increase in year-over-year shipments in Q4. Overall blade servers accounted for $1.8 billion in Q4 2009 (up from $1.3 billion in Q3) which represented 13.9% of the overall server revenue. It was also reported that more than 87% of all blade revenue in Q4 2009 was driven by x86 systems where blades now represent 21.4% of all x86 server revenue.

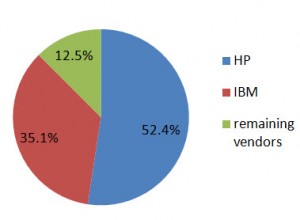

While the press release did not provide details of the market share for all of the top 5 blade vendors, they did provide data for the following:

#1 market share: HP with 52.4%

#2 market share: IBM increased their marketshare from Q3 by 5.7% growth to 35.1%

As an important note, according to IDC, IBM significantly outperformed the market with year-over-year revenue growth of 64.1%.

According to Jed Scaramella, senior research analyst in IDC's Datacenter and Enterprise Server group, "Blades remained a bright spot in the server vendors’ portfolios. They were able to grow blade revenue throughout the year while maintaining their average selling prices. Customers recognize the benefits extend beyond consolidation and density, and are leveraging the platform to deliver a dynamic IT environment. Vendors consider blades strategic to their business due to the strong loyalty customers develop for their blade vendor as well as the higher level of pull-through revenue associated with blades."