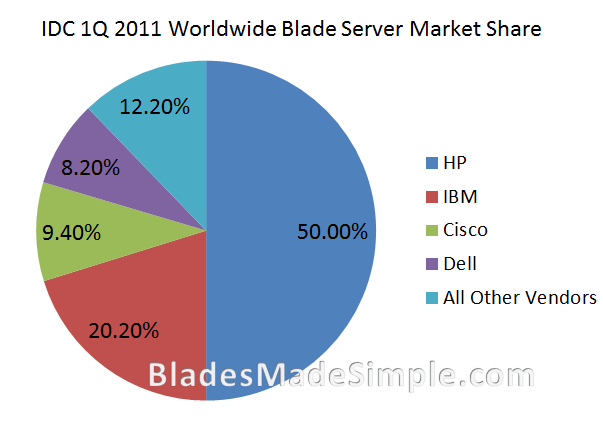

May 24, 2011 – IDC came out with their 1Q 2011 worldwide server market revenue report today showing that Cisco has finally entered the market standings with a 3rd place standing at 9.4% factory revenue share . IDC’s findings also showed that both HP and IBM decreased their blade server market share from Q4 2010.

According to IDC, worldwide server sales (all servers, not just blade servers) for 1Q 2011 increased 12.1 % year over year to $11.9 billion in factory revenues. IDC also reported the blade server market accelerated and continued its strong growth in 1Q with revenue increasing 23.8% year over year with shipments increasing to 5.4% compared to 1Q 2010. Overall, blade servers represent 15.2% of the quarterly worldwide server revenues. Interestingly enough, 90% of all blade revenue is driven by x86 systems, a segment in which blades now represent 20.5% of all x86 server revenue.

Here’s a summary of the top 4 blade server market share (based on factory revenue share):

#1 market share: HP decreased their market share from 53.4% in Q4 2010 to 50.0% in Q1 2011

#2 market share: IBM decreased their market share from 28.1% in Q4 2010 to 20.2% in Q1 2011.

#3 market share: Cisco at 9.4% in Q1 2011

#4 market share: Dell at 8.2% in Q1 2011

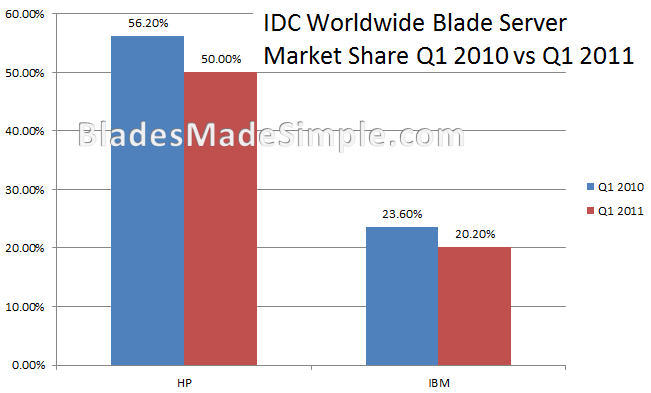

HP maintains the #1 market share spot now holding an impressive 50% of all blade server factory revenue market share. An interesting observation, though, is that both HP and IBM have fallen over the past 12 months when compared to Q1 2010. As you can see in the chart, HP dropped 6.2% market share and IBM fell 3.4% market share year-over-year. Is this contributed to Cisco’s entry into the market place?

According to Jed Scaramella, research manager, Enterprise Servers at IDC, “After several years of being a highly consolidated market where the top 3 vendor accounted for over 80% of blade revenue, the recent entry of Cisco has introduced a viable new competitor to the market.” While the quantities of Cisco UCS customers were not mentioned into the IDC report, according to Cisco’s Omar Sultan’s blog (http://blogs.cisco.com/datacenter/they-were-wrong-about-ucs-what-else-are-they-wrong-about/) , there are 3,820 customers as of Cisco’s 2nd Fiscal Quarter 2011.

According to Jed Scaramella, research manager, Enterprise Servers at IDC, “After several years of being a highly consolidated market where the top 3 vendor accounted for over 80% of blade revenue, the recent entry of Cisco has introduced a viable new competitor to the market.” While the quantities of Cisco UCS customers were not mentioned into the IDC report, according to Cisco’s Omar Sultan’s blog (http://blogs.cisco.com/datacenter/they-were-wrong-about-ucs-what-else-are-they-wrong-about/) , there are 3,820 customers as of Cisco’s 2nd Fiscal Quarter 2011.

For a full summary of the IDC Quarterly Server Tracker report, visit my other blog at:

http://corus360.com/company/blog/idc-shows-hp-as-the-server-leader-for-q1-2011

Cisco makes an impressive showing, eclipsing Dell at their first IDC measurement. I see this as indicating Cisco’s strong relationships with IT senior staff compared with Dells limited relationship with them.

I’m shocked that HP has lost so much market share from their peak of more than 60%. I see that as taking their eye off the ball and resting on their laurels (to mix some metaphors). If they choose to focus on the game, watch out!This is going to be a fun battle to watch!

Pingback: Kevin Houston

Pingback: Kevin Houston

Pingback: Toru OZAKI

Pingback: Shelley Ann Hanson

Pingback: Shelley Ann Hanson

Pingback: Kong Yang

Pingback: Ed Swindelles

Pingback: Dell Enterprise Team

Pingback: Doron Chosnek

Pingback: jasonviera

Pingback: Edemilson F. Vieira

Pingback: Rob

Pingback: Michael Saul

Pingback: Joe Onisick

Pingback: William Toll

Pingback: Bob Sokol

Pingback: Tony Harvey

Pingback: Peter Busque

Pingback: Kevin Houston

Pingback: Adrian D Ho

Pingback: Kevin Houston

Pingback: Mark S A Smith

Pingback: Joseph Kordish

Pingback: Tim Silk

Pingback: Michael Campbell

Pingback: Marcel van den Berg

Pingback: Momchil V. Michailov

Pingback: Amit Schnitzer

Pingback: David Cahill

Pingback: Dima Barsky

Pingback: Will Forrest

Pingback: Rob Bergin

Pingback: Paul Burns

Pingback: Richard Smith

Pingback: Eric van der Meer

Pingback: Juan Camilo Cardona

Pingback: paul beckett

Pingback: poseydonn

Pingback: Michael Lee

Pingback: Michael Lee

Pingback: Juan Lage

Pingback: harmeetchauhan

Pingback: Adolfo Bolivar

Pingback: Kevin Houston

Pingback: Kevin Houston

Pingback: Felipe Locato

“CEO John Chambers also said at the time that he will pull back from other businesses that Cisco isn’t No. 1 or No. 2 in” – http://ow.ly/52Uzp

Guess what? Cisco is nowhere close to being #2. Is UCS in trouble?

Pingback: Dave Kamp

Greg, nice try :-)

The quote is take a bit out of context of course and you know it. John has said for a long time that it is Cisco’s goal to be #1 or #2 in the markets it is competing in.

Obviously you never start a new business as #1 or #2. Your products need to be so good and architecturally sound that customers love it and allow you to grow to the #1 or #2 position. And that is what is happening at a very rapid pace.

Growing from 0% to nearly 10% globally in just 2 years – achieving the #3 position globally, that is a massive achievement and at this rate I would be very nervous if I were the current #2 vendor (soon to be #3 vendor)

Regards

TJ

disclaimer: love UCS, work for Cisco in the DC team

Thank god they finally came out with numbers. I think that these are great for Cisco! Just for reference, I’d be curious to know a couple more things:

– How many years have HP and IBM been in the blade server market?

– What % market share did they both have at 2 years?

Those questions might not be fair because I’m sure the game was much different then, but my point is that 9.4% after 2 years seems pretty darn good – especially seeing how their architecture is so wildly different than the rest.

Don’t get me wrong, I don’t think Cisco is a bad company at all and certainly 10% market share in two years is very, very respectable. But this essentially equates to $180m in new business for a $40B company.

How much networking business is Cisco losing because UCS has inflamed HP, Dell and IBM? This was a subject we dived into on Infosmack this week:

http://www.theregister.co.uk/2011/05/24/infosmack_episode_100/

I don’t think UCS is a bad product at all, I just question the strategy.

One question on the numbers. How many units has Cisco actually shipped? When IDC says someone is in X place, is that based on actual units shipped (not revenue, but units) and does it cover what’s currently installed in data centers? In other words, if I went into all the data centers in the world and counted blade servers, would Cisco be in third place? If so, that’s awesome because that is a lot of units to ship.

It just goes to show how much of a game changer Cisco UCS is turning out to be.

Adam

Disclosure: I work for VCE.

Pingback: John Obeto

Pingback: John Obeto

Pingback: Carl Brooks

Pingback: Greg Knieriemen

Pingback: Dan Lah

Pingback: John Obeto

It seems that the real defining factor for market acceptance and share is really UNIT SHIPMENTS….not revenue share. What is included in Revenue Share? Is this JUST the blade revenue – excluding the chassis, switches etc. etc. ? What is REALLY telling is UNIT shipments…….for Q4’10(Q2 for Cisco) it was reported that HP shipped 152,000 blades and that Cisco shipped 18,000 with UCS revenue of $162M. That equates to an average UCS Blade selling price of $9,000. Using that to calculate the latest quarter shipments . $171M divided by $9,000 yields 19,000 blades – a 5.5% increase. But how many blades have they REALLY shipped? At the revenue shares that IDC reported – 50% for HP – that’s about $900M in blade revenue for the latest quarter for HP. Assuming conservatively that HP blade shipments increased 5% – 160,000 blades were shipped by HP in the last quarter – and – the average selling price would be around $5,600 – verses the Cisco calculated selling price of $9,000……for basically commodity x86 blades.So, what is in the Cisco UCS revenue number? Is it blades ONLY ? Does it include the switches? Customers buy server UNITS to host workloads – that’s the basic value proposition. I think the indicator of acceptance and market share is how many blades(servers) customers are buying – that ‘s the real gage of market share. If one vendor sells two servers for $5000 each and the other vendor sells ONE server for $10,000 – who is the market leader? Is it a tie? If we really want to know what the market shares are, we really should be talking unit shipments……

Mark,

your use of “eclipse” is in the eye of the beholder.

1) Per IDC Dell shipped 27K blades WW in Q1, Cisco shipped 17K. that is nice growth, but they are still FAR behind Dell in x86 blades from a unit share perspective, which is how most people think of market share

2) when cisco reports revenue to IDC, they report blades, chassis, FEX, and UCS 6100 fabric interconnect. Dell reports Blades & Infrastructure (chassis) revenue, all our FC & Ethernet blade switches are reported as part of storage and networking product lines. Thus Dell doesnt get “credit” in this kind of report for the revenue in the same way cisco does. there are valid reasons for each, but based on this you can see that revenue share has issues of not being apples to apples compare. If Dell reported all its blade switch revenue as part of the blades to IDC, we’d be ahead of Cisco in terms of revenue share (by ~$20M)

I work for Dell- Mike

Dan,

I agree with you, as i pointed out above, the way each company reports revenue associated with various elements is different. Cisco reports FEX and 6100 as blade revenue, Dell doesnt include blade IO switches (not sure about HP/IBM). Generally people think of market share in terms of units and by that measurement, Cisco is a distant 4th in WW share (17.5K vs. 27K for Dell).

Mike (i work for Dell)

Adam,

IDC reported cisco shipped 17.5K blades in Q1’11. Dell shipped 27K, IBM ~54K, and HP ~123K. that means shipped out of the factory that quarter, it is NOT how many blades are out there in datacenters. Cisco would be far from in 3rd place if you did that, they have only been shipping 2 years. IDC says they have shipped about 55K blades TOTAL over 2 yrs, for context Dell has shipped about 250K in that timeframe.

mike

Tjerk,

agree with you that there needs to be time to grow, but as i’ve pointed out above, you are talking about revenue share and there are some very different methodologies being used. in terms of units (which is how most people view market share – or in switches its all about ports), cisco is still a distant #4 in x86 blades and they are not close at all to #2 IBM. and also remember that x86 blades are a small subset of the overall x86 server market (cisco has about 1% share of that market and are in ~8th place). for context, cisco has less share in the x86 server market than fujitsu, lenovo, and NEC and are about where oracle is for x86 (not oracle RISC). again for context, Dell is #2 in x86 servers and shipped 508k x86 servers last quarter.

maybe they get there, but they have a long way to go to even get #2 in x86 blades.

Mike

Pingback: Peter Teuschitz

Pingback: Angelo Luciani

Pingback: Stefanie Beach

Pingback: Shaun

Pingback: Cisco Qld SMB Team

Pingback: Lore Systems

Interesting point that #Cisco reports FEX and 6100 as blade revenue whereas no one else does. Could that impact the “factory revenue” numbers? Possibly. Thanks for the comments, Mike!

Dan – interesting comment on #Cisco UCS shipments. Perhaps it would be a fairer comparison to see # of blades shipped, but then you run into the “not every blade server is equal”. I’m afraid there’s no real way to measure market share aside from factory revenues. Thanks for the comment!

Mark – I agree that it appears #HP has taken their eye off the ball, especially when you look at their year over year market share. Since you have consulted with HP in the past, what do you think HP needs to do to regain blade server market share?

Joe – I searched for #HP and #IBM ‘s first year blade sales numbers, but I didn’t have any luck. IBM’s been selling blades since 2001 and that data is lost in the archives. While I hope that HP and IBM will provide some competitive comparisons on their first 2 years of sales, I think it’s clear that Cisco is serious about UCS. Thanks for your comment!

kevin,

it absolutely does impact factory revenue and would push Dell above UCS in revenue based on our data. i can see why they do report it that way as you can run UCS without the FEX & 6100. i dont know what IBM/HP do. this is why unit share is a better measure of market position.

Mike,

I work for Cisco. You cannot run a UCS chassis without the FEX and 6100 interconnects. It’s designed and built together. You include your interconnects are you mention. Based on your entire comment, it sounds like you might have just left off the “not” which changes everything. FWIW, our FEX modules are pennies in the total cost. If I were in your shoes at Dell, I would probably try to make the same arguments though.

thanks jeff, i fixed my post. correct on FEX being small but 6100 is a fairly large $$ item

Yes Greg, UCS is in trouble. I also understand that Coke is throwing the towel to Pepsi and going out of business.

Disclaimer: I work for Cisco on the UCS team and was with HP on the Bladesystem team for a decade prior.

Greg,Your timeline is all wrong. You act as if Cisco went looking for a fight with HP. Was Virtual Connect not the first shot fired in the souring of the relationship? Attacking the access layer business of Cisco certainly didn’t make Cisco happy – seeing as how they were “partners” at the time….

Disclaimer: I work for Cisco on the UCS team and was with HP on the Bladesystem team for a decade prior.

Greg,Your timeline is all wrong. You act as if Cisco went looking for a fight with HP. Was Virtual Connect not the first shot fired in the souring of the relationship? Attacking the access layer business of Cisco certainly didn’t make Cisco happy – seeing as how they were “partners” at the time….

Look…. I’m not trying to pick a fight here, I’m just saying that it’s not clear to anyone outside of Cisco that the gains UCS has made have outpaced the loses on the networking side – and I think the two are related. This is about strategy. It doesn’t matter who started the HP/Cisco fight, all that counts are the results.

Disclosure: I don’t have a horse in this race, I have nothing to do with Cisco or HP on servers or switches.

Greg,

I think I mistook “Cisco is nowhere close to being #2. Is UCS in trouble?” as fighting words. It’s one thing for sure – FUD. It’s a classic case of FUD where you are trying to cast a shadow of fear, uncertainty, and doubt. Also, you changed the focus of your argument from “UCS being in trouble” to comparing Network/Server losses and gains so I’m not totally sure which comments you are responding to. I’m happy to debate the former point.

I would disagree that we’re “nowhere close to being #2”. In the x86 blade server market that we actually compete in, we’re tied for #2 in NA, we are #2 in the US, and we’re over half way to being #2 WW. Can you agree that this is pretty good for a rookie in the server market? Can HP claim that their ranking in the networking space has done as well in their short time as a networking company (not counting the now low-end Procurve stuff)? Dell has been shipping blades for a decade and we passed them on factory revenue in just 2 years. This is beyond beginners luck. We’re truly not a “me too” blade maker. we are doing things drastically different – and doing it with quality hardware and software. Customers are agreeing.

On your 2nd point, let’s say the server gains have not outpaced network losses – what if that were true? What would your answer be? You seem to be saying that UCS is a bad strategy and that we should abandon ship on a booming business. There is no data that makes this correlation outside of your assumption. They could be no more related than gains in Telepresence causing losses in networking. Our overall corporate strategy is well above my pay grade, but I can confidently say that no sane person turns their back on a business that’s churning $1B in it’s first 24 mos. Would you?

Pingback: Scott Hanson

Pingback: M. Sean McGee

Pingback: Go Communications

jeff,

cisco is #4 in blade unit share WW and in every geography. in the x86 world people measure share in units, just like in switches they measure it by ports. its nice growth, but we’re talking about 17k blades in a quarter, while Dell did 27k, so that is a distant #4 to me.

Dell has been shipping blades for a decade, but we have always been relatively form factor agnostic. Dell’s blades have grown nicely but rack and cloud optimized servers have shown huge growth as well.

When cisco started shipping UCS in 2009 Dell shipped ~400k servers/quarter (all form factors) and had server revenue of ~$1.2B. this quarter we shipped over 500k servers (100k more than Q2’09) & had server revenue ~$1.9B ($700M more than Q209). cisco went from 0-20k servers and $0 to ~$200M. the scale is completely different, so is that really ‘booming” business in this market?

I think it is a fair point to ask (no one knows) will cisco’s exec team be OK with being a 3-4th place vendor in a subset of (but growing) the overall server market, when they have to have invest significant resources in dedicated and specialized sales, system engineering, ASIC development, alliances, channel, and marketing people…. All of this being supported by relatively small revenue/volume. companies make those decisions all the time about walking away from business that dont make sense for them (e.g. IBM in PCs, oracle got out of general purpose x86 servers when they bought sun, Cisco with Topspin…) even when they are bringing in seemingly nice revenue. who knows

mike

Disclaimer: I work for Cisco

How is comparing units shipped fair? Cisco’s solution is designed to do more with Virtualization, and hence you need LESS physical blades.

Revenue is more fair. Customers are buying solutions, not body counts. If they are paying to get less blades from Cisco but getting the expected solution they need, then this is a more realistic comparison.

Pingback: Rene Bosman

Pingback: Cisco Israel

mohammed,

you can argue which is better all day long, but fact is everyone’s blades are highly virtualized, its not just cisco. it is completely understandable how cisco counts blade revenue for UCS, others report revenue differently today so it really isnt apples to apples in the IDC data. customers are buying solutions but at what point do you stop? does this mean you should count storage, external switches, software, services… into blade revenue? units are much more concrete.

also to your point about paying less, if you look at the IDC data it tells you that customers are paying nearly 2x for a cisco blade vs. a Dell blade (factory rev/units), HP, or IBM blade because of the way revenue is counted.

mike

Mike,

I don’t see what is wrong by looking at revenue market share. If I follow your logic, Dell shipped more units and received less money for it and that somehow is better?

I think you can look at both, units as well as revenue, but I’ll take revenue numbers over unit numbers any day.

TJ

Pingback: Gurp Gahunia

On a closely related note to gaining/losing market share, the below is certainly disturbing. Anyone here had a similar experience they can share? Do any of the other big box vendors do this, or just Cisco?

http://www.bloomberg.com/news/2011-06-02/cisco-rivals-woo-customers-with-price-cuts-less-intimidation-.html?cmpid=yhoo

I work for Cisco on the Commercial West DC Team. I’d argue, in the current environment, in Commercial West we are winning more than 70% of the Blade Deals we are involved in. It’s the deals we don’t know about that bother us and allow the other vendors to continue boasting about their market share #’s. When we have lost a deal it’s never because the customer tells us the competitors technology is better, it’s always because of Price. UCS is that compelling, and for those that don’t agree, then perhaps you don’t understand it entirely. I encourage you to Bake it off side by side–w/ Insight Manager, addtl Mngt software stacks, AIM from DELL etc. all don’t live up to the capabilities of Stateless computing and Service Profiles of UCS. The fact we include Fabric Interconnects and FEX’s in the #’s is because it’s a system, not a piecemeal approach that allows for the devaluation of the whole by putting in a weak link like Virtual Connect or Blade Switch XYZ. As I look at the 500+ UCS customers my team supports in the West, it’s a who’s who of corporations w/ really smart people working for them who believe in UCS and it’s now supporting their companies entire business. Are you questioning their intelligence because to me “all the Smart People are buying UCS” — ALL of those deals were competitive against HP, DELL and IBM.

To Greg’s point about “how much switching” business is Cisco losing? I’d have to say this is an evolution of the Market from 1G to 10G to FCoE, to Fabric Based Computing. The simple fact is you now need less ports for more performance in the DC. In the case of UCS we’re trading a significant # of ports for Processors. It’s the Edge/Access layer that’s under attack and I would imagine EVERY switch Vendor is keenly aware of what OpenFlow means to everyones business- as Openflow takes off it’s the companies like Cisco w/ tangible features, support, and $$$ that will continue to lead and innovate. Where will this leave HPQ, Dell, Juniper, extreme, FoundBrocData, and others.?

For those doubters out there who think UCS is still insignificant and that the market share #’s are still small, just harken back to the days of IBM SNA, 3Com, Cabletron, Bay Networks, Nortel, Avaya, and probably another dozen companies I’ve left off who felt the same way when first competing agianst Cisco.

Remeber that we took our designs to HP and IBM first and asked to partner — they were the one’s who said NO which forced us to go solo– Now they’ll see for themeselves what they turned down.

UCS is here to stay, On to #2 Worldwide!!!

Sorry guys, but Market share IS Revenue, Not units shipped.

TAM (Total Addressable Market) has always been calculated in Revenue, not quantity. (http://en.wikipedia.org/wiki/Total_addressable_market)

The TAM for x86 servers world wide is currently about $57B

Based on this, the #2 and #3 spot that Cisco claims is accurate. IDC also agrees with this.

And no, I don’t work for Cisco.

Pingback: WorkingHardInIT

Pingback: Jasper

Pingback: massimo facchinetti

Pingback: social media

In your dreams

Was researching to see if the latest IDC numbers were posted, and always love re-reading this post with the hindsight we have now.

Pingback: Technology Passion – Define The Cloud