As I’m anxiously awaiting the Q4 2010 IDC blade server market share results from IDC (due out around the week of Feb 28, 2011), I figured I’d take a risk and see if I can trend what the results may be. Here’s what I found.

Disclaimer – this post is purely speculation and is not based on any future information that IDC may provide. This speculation is solely provided for entertainment and should not be used in any other manner than that.

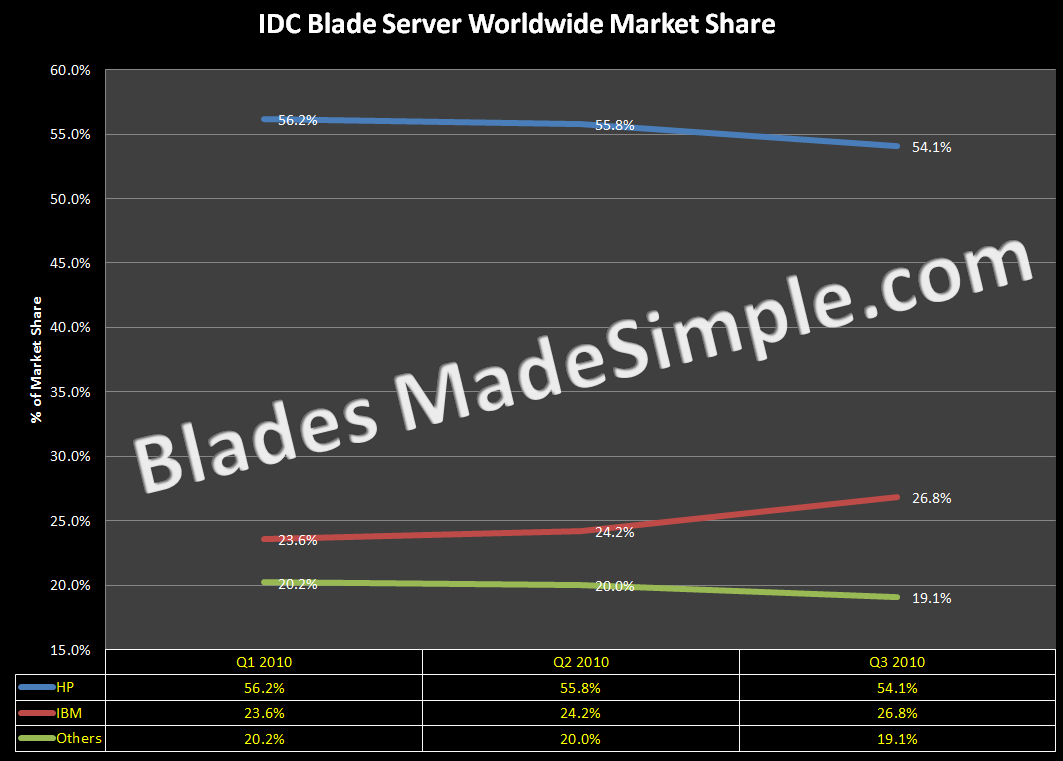

Before I attempted to trend out what Q4 would look like, I had to review what I found in Q1 – Q3 of 2010:

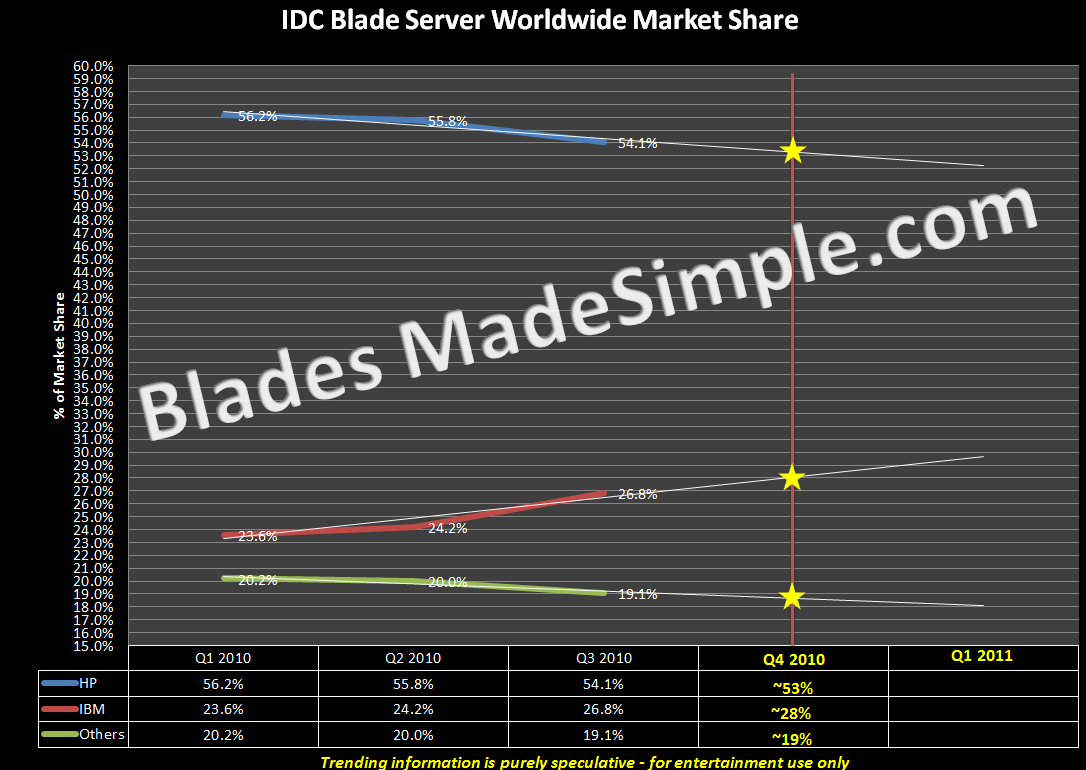

Next, I chose to add a Linear Forecast Trendline using Microsoft Excel. Here’s what I came up with:

I have to admit, I don’t have any experience “trending” data, so I’m relying on Microsoft to point me in the right direction, however based on that information, I predict the following Q4 2010 worldwide blade server market share results:

HP: ~53% market share

IBM: ~28% market share

Others (Dell, Fujitsu, etc.): ~19%

Those are my predictions – what are yours?

While sales trends are interesting, I’m curious if you have reaction on the Garnter MQ for blade servers http://www.gartner.com/technology/media-products/reprints/hp/vol3/article7/article7.html

Do you agree that IBM and HP are far ahead of the competition from an innovation standpoint?

Do you think that Cisco will be more than just lumped into “Other” in revenue in the coming quarters?

Pingback: Kevin Houston

Pingback: unix player

Hi folks,

I’m an HP reseller and I can tell you that in Q4 I’ve never done more business with HP blades, in fact it was the best quarter ever. I have heard similar from a other resellers and from the HP folks as well. I’m guessing 55%+ especially if these numbers include HPUX Itanium blades that are also taking off with the new bl860, bl870 and bl890 blades, great strategy!

Betting on 55%, HP killed in Q4.