May 24, 2011 – IDC came out with their 1Q 2011 worldwide server market revenue report today showing that Cisco has finally entered the market standings with a 3rd place standing at 9.4% factory revenue share . IDC’s findings also showed that both HP and IBM decreased their blade server market share from Q4 2010. Continue reading

Category Archives: IDC

Q4 2010 IDC Worldwide Server Market Shows Blade Server Leader As…

IDC came out with their 4Q 2010 worldwide server market revenue report on Feb. 28, 2011 which shows that IBM continued to grow from Q3 2010 in their blade market share while HP dropped in market share. Continue reading

Blade Server Market Share Comparison – Q3 2009 vs Q3 2010

I was updating a slide deck that I use to compare blade server technologies for customers when I came across the IDC and Gartner data from Q3 of 2009. I was very surprised at what I found out, so today’s post takes a look back at 2009 and compares it to 2010. Continue reading

Speculating Q4 2010 Blade Server Market Share Results

As I’m anxiously awaiting the Q4 2010 IDC blade server market share results from IDC (due out around the week of Feb 28, 2011), I figured I’d take a risk and see if I can trend what the results may be. Here’s what I found. Continue reading

IBM Gains Blade Server Market Share in Q3 2010

IDC came out with their 3Q 2010 worldwide server market revenue report last month which shows that IBM grew from Q2 2010 in their blade market share. Continue reading

Still Confused About Cisco’s Blade Market Share

I recently received a comment on my previous post concerning Cisco’s market share (“What’s the Truth About Cisco’s Market Share“) which has me more confused. The comment admits that Cisco has not released any market share data to IDC, but that when you look at the Cisco Q1 2010 Earnings Call and compare it to IDC’s findings of the overall industry you should be able to derive conclusions from there. That’s where it gets confusing. Continue reading

REVISED HP Loses Blade Market Share in Q2

Revised 9/29/2010 – I previously titled this blog post, “HP Loses Blade Server Market Share to IBM…” however I have since re-thought that statement. The report from IDC does not specify where HP’s blade server market share went from Q1 2010 – it only provides Q2 2010 market share numbers. I regret any confusion I may have caused.

Continue reading

(UPDATED) IDC Q1 2010 Report: Blade Servers Growing, With #1 Market Share Going To…

NOTE: IDC revised their report on May 28, 2010. This post now includes those changes.

IDC reported on May 28, 2010 that worldwide server sales for Q1 2010 factory revenues increased 4.6 4.7% year over year to $10.4 billion in the first quarter of 2010 (1Q10). They also reported the blade server market accelerated and continued its sharp growth in the quarter with factory revenue increasing 37.1% 37.2% year over year, with shipment growth increasing by 20.8% compared to 1Q09. According to IDC, nearly 90% of all blade revenue is driven by x86 systems, a segment in which blades now represent 18.8% of all x86 server revenue. Continue reading

IDC Q4 2009 Report: Blade Servers STILL Growing, HP Leads STILL Leading in Shares

IDC reported on February 24, 2010 that blade server sales for Q4 2009 returned to quarterly revenue growth with factory revenues increasing 30.9% in Q4 2009 year over year (vs 1.2% in Q3.) For the first time in 2009 there was an 8.3% increase in year-over-year shipments in Q4. Overall blade servers accounted for $1.8 billion in Q4 2009 (up from $1.3 billion in Q3) which represented 13.9% of the overall server revenue. It was also reported that more than 87% of all blade revenue in Q4 2009 was driven by x86 systems where blades now represent 21.4% of all x86 server revenue.

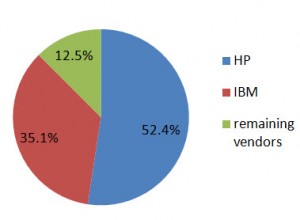

While the press release did not provide details of the market share for all of the top 5 blade vendors, they did provide data for the following:

#1 market share: HP with 52.4%

#2 market share: IBM increased their marketshare from Q3 by 5.7% growth to 35.1%

As an important note, according to IDC, IBM significantly outperformed the market with year-over-year revenue growth of 64.1%.

According to Jed Scaramella, senior research analyst in IDC's Datacenter and Enterprise Server group, "Blades remained a bright spot in the server vendors’ portfolios. They were able to grow blade revenue throughout the year while maintaining their average selling prices. Customers recognize the benefits extend beyond consolidation and density, and are leveraging the platform to deliver a dynamic IT environment. Vendors consider blades strategic to their business due to the strong loyalty customers develop for their blade vendor as well as the higher level of pull-through revenue associated with blades."

IDC Q3 2009 Report: Blade Servers are Growing, HP Leads in Shares

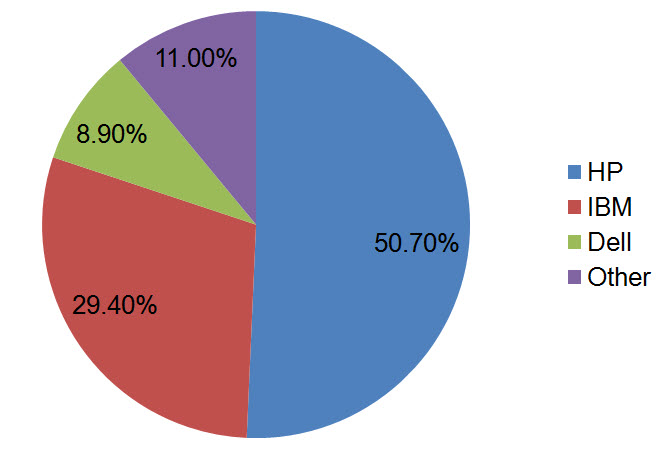

IDC reported on Wednesday that blade server sales for Q3 2009 returned to quarterly revenue growth with factory revenues increasing 1.2% year over year. However there was a 14.0% year-over-year shipment decline. Overall blade servers accounted for $1.4 billion in Q3 2009 which represented 13.6% of the overall server revenue. Of the top 5 OEM blade manufacturers, IBM experienced the strongest blade growth gaining 6.0 points of market share. However, overall market share for Q3 2009 still belongs to HP with 50.7%, with IBM following up with 29.4% and Dell in 3rd place with a lowly 8.9% revenue share. According to Jed Scaramella, senior research analyst in IDC's Datacenter and Enterprise Server group, "Customers are leveraging blade technologies to optimize their environments in response to the pressure of the economic downturn and tighter budgets. Blade technologies provide IT organizations the capability to simplify their IT while improving asset utilization, IT flexibility, and energy efficiency. For the second consecutive quarter, the blade segment increased in revenue on a quarter-to-quarter basis, while simultaneously increasing their average sales value (ASV). This was driven by next generation processors (Intel Nehalem) and a greater amount of memory, which customers are utilizing for more virtualization deployments. IDC sees virtualization and blades are closely associated technologies that drive dynamic IT for the future datacenter."

According to Jed Scaramella, senior research analyst in IDC's Datacenter and Enterprise Server group, "Customers are leveraging blade technologies to optimize their environments in response to the pressure of the economic downturn and tighter budgets. Blade technologies provide IT organizations the capability to simplify their IT while improving asset utilization, IT flexibility, and energy efficiency. For the second consecutive quarter, the blade segment increased in revenue on a quarter-to-quarter basis, while simultaneously increasing their average sales value (ASV). This was driven by next generation processors (Intel Nehalem) and a greater amount of memory, which customers are utilizing for more virtualization deployments. IDC sees virtualization and blades are closely associated technologies that drive dynamic IT for the future datacenter."