I recently was asked, am I seeing server vendors exiting the blade server market? If so, what are they selling in place of blades? Honestly, I was surprised by the question. The only whisper of any exits from the blade market were stirred up last year with the rumors of Cisco exiting. I address that in this post, but I wanted to see if there was any validity into what was being asked, so I dug around. I was surprised by what I found.

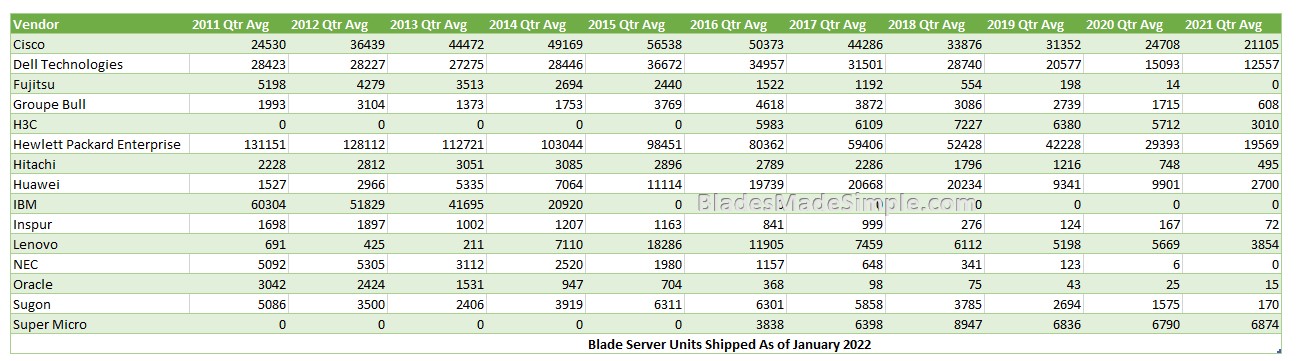

Although I typically only blog about “Tier 1” vendors, I was able to get the ten year data of blade server units shipped across all server vendors. In the table below, I chose to look at the average units shipped for each year.

I expected the data to show decreases in units shipped, but I was not expecting to see this trend starting in 2015. Take a closer look at that chart. Every server vendor either peaked or hits the peak of maximum units sold per quarter in 2015. In the years that follow, the monthly averages drop.

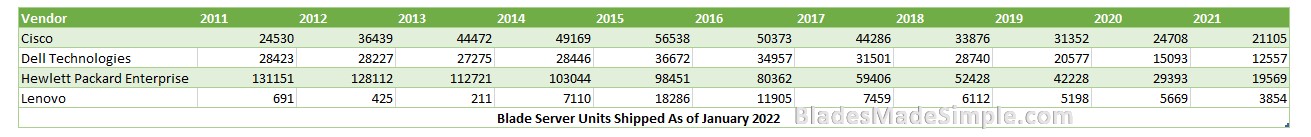

Here’s another view limiting the data to “Tier 1” vendors: Cisco, Dell, HPE and Lenovo.

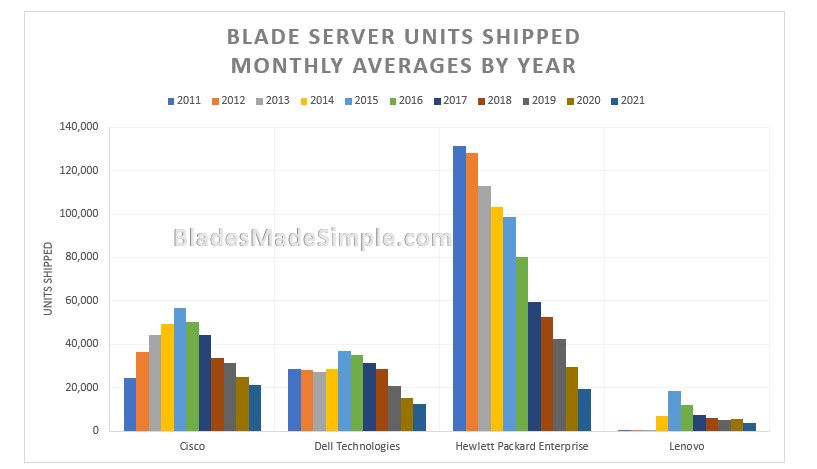

For those of you who like charts, here’s the same data in a visual form.

Is there a reason for this decline in shipped units? I wrote my thoughts on this in May of 2021 (“Are We Nearing the End of Blade Servers“) but in summary I think it comes down to a simple reason: as technology advances, power increases making a dense environment like blade servers less desirable.

I’d welcome any thoughts you have on this. Feel free to leave a comment below or email me. Thanks for your continued support.

Kevin Houston is the founder of BladesMadeSimple.com. With over 24 years of experience in the x86 server marketplace Kevin has a vast array of competitive x86 server knowledge and certifications as well as an in-depth understanding of VMware virtualization. He has worked at Dell Technologies since August 2011 and is a Principal Engineer supporting the East Enterprise Region and is also a CTO Ambassador for the Office of the CTO at Dell Technologies. #IWork4Dell

Kevin Houston is the founder of BladesMadeSimple.com. With over 24 years of experience in the x86 server marketplace Kevin has a vast array of competitive x86 server knowledge and certifications as well as an in-depth understanding of VMware virtualization. He has worked at Dell Technologies since August 2011 and is a Principal Engineer supporting the East Enterprise Region and is also a CTO Ambassador for the Office of the CTO at Dell Technologies. #IWork4Dell

Disclaimer: The views presented in this blog are personal views and may or may not reflect any of the contributors’ employer’s positions. Furthermore, the content is not reviewed, approved or published by any employer. No compensation has been provided for any part of this blog.