( UPDATED 3/7/12) With the launch of Intel’s Xeon E5-2600 processor, Dell revealed the details of the new PowerEdge M620 blade server. Offering an industry first 24 memory DIMMs in a half-height form factor, the M620 offers up to 768GB of RAM along side the newly announced Intel E5-2600. The Dell PowerEdge M620 also comes with the ability to chose from a variety of LOM (LAN on Motherboard) cards – a feature first seen in the PowerEdge M710HD and M915 last Summer. Formerly known as the Network Daughter Card, the newly renamed feature, called Select Network Adapter, is a removable network card that gives buyers the option of choosing from Broadcom, Intel or QLogic adapters – each offering up to two ports of 10Gb. Since it is removable, it offers investment protection as new technology becomes available. For more features and details about the M620, see below.

UPDATED 3/7/12) With the launch of Intel’s Xeon E5-2600 processor, Dell revealed the details of the new PowerEdge M620 blade server. Offering an industry first 24 memory DIMMs in a half-height form factor, the M620 offers up to 768GB of RAM along side the newly announced Intel E5-2600. The Dell PowerEdge M620 also comes with the ability to chose from a variety of LOM (LAN on Motherboard) cards – a feature first seen in the PowerEdge M710HD and M915 last Summer. Formerly known as the Network Daughter Card, the newly renamed feature, called Select Network Adapter, is a removable network card that gives buyers the option of choosing from Broadcom, Intel or QLogic adapters – each offering up to two ports of 10Gb. Since it is removable, it offers investment protection as new technology becomes available. For more features and details about the M620, see below.

Tag Archives: Dell

IDC Reports Q4 2011 Shows Continued Blade Server Growth

The International Data Corporation’s (IDC) released their Worldwide Quarterly Server Tracker today covering Q4 2011. Despite a 7.2% decrease in the worldwide server factory revenue, the blade market continued to experience growth in 4Q11 with factory revenue increasing 8.3% year over year. Other key facts from the IDC press release: Continue reading

Where Did Blade Servers Come From?

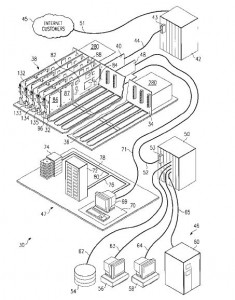

As I mentioned yesterday, one of my fellow bloggers, Stephen Foskett, is writing a series on blade servers. His latest post reveals the history of the blade server. Stephen’s article challenged me to do some research of my own – and here’s what I found. Apparently the first “official” patent for a server on blade (patent # 6,411,506 – “High density web server chassis system and method) was awarded in June of 2002 to Christopher G. Hipp and David M. Kirkeby of RLX Technologies. One interesting fact is that U.S. Patents referenced within the document refers to other patents from many leaders of the industry including IBM, Hewlett-Packard, Micron, Hitachi and even Dell.

As I mentioned yesterday, one of my fellow bloggers, Stephen Foskett, is writing a series on blade servers. His latest post reveals the history of the blade server. Stephen’s article challenged me to do some research of my own – and here’s what I found. Apparently the first “official” patent for a server on blade (patent # 6,411,506 – “High density web server chassis system and method) was awarded in June of 2002 to Christopher G. Hipp and David M. Kirkeby of RLX Technologies. One interesting fact is that U.S. Patents referenced within the document refers to other patents from many leaders of the industry including IBM, Hewlett-Packard, Micron, Hitachi and even Dell.

I’ve taken the liberty of downloading the entire patent document for your reference:

High Density Web Server Chassis – Patent 6411506 B1 (1.84Mb, PDF).

If you like technology and are a history buff, I recommend you check out Stephen’s article at http://blog.fosketts.net/2012/02/20/blade-server-history/.

Kevin Houston is the founder and Editor-in-Chief of BladesMadeSimple.com. He has over 15 years of experience in the x86 server marketplace. Since 1997 Kevin has worked at several resellers in the Atlanta area, and has a vast array of competitive x86 server knowledge and certifications as well as an in-depth understanding of VMware and Citrix virtualization. Kevin works for Dell as a Server Specialist covering the Global 500 East market.

Q3 2011 IDC Worldwide – Steady as She Goes

Hot off the presses is the latest IDC worldwide server market revenue report for Q3 2011. The gist of the report is that while some of the numbers are slightly adjusted, really not much has changed in the blade server market.

Revenue growth for the entire server market (all servers, not just blade servers) slowed considerably showing only 4.2% year over year growth bringing in $12.7 billion. Growth in the world of servers continues but this marks the slowest growth rate for any quarter since Q1 2010. IDC believes that overall server sales will continue to decelerate due to weakening economic conditions around the globe. “After nearly two years of steady revenue growth, the server market began to decelerate in Q3 2011 as demand stabilized for many system categories,” said Matt Eastwood, group VP and general manager. Incidentally, IBM and HP are both holding steady, tied for the #1 spot in revenue share, at 29.8%.

When looking at the blade server market specifically, growth was steady for Q3 2011 but not as explosive as Q2 2011. IDC reports “solid growth” in the quarter with a revenue increase of 16.4% year over year (vs 26.9% growth in 2Q11). Shipments increased 2.4% (vs 6.2% reported growth for 2Q11). One thing that hasn’t changed since last quarter is that 89% of all blade revenue is driven by x86 systems. Also, blade server sales representing 20.8% of all x86 server revenue. This shows continued steady growth for the blade server segment but that the pace may be slowing slightly.

#1 market share: HP managed to hold the majority margin moving to 51.0% in Q3 2011 from 51.9% in Q2 2011.

#2 market share: IBM continues to see its margin chipped away slightly down to 18.5% in Q3 2011 from 19.1% in Q2 2011.

#3 market share: Cisco’s disruptive market penetration seems to have slowed at 10.7% overall compared to a solid 10% in Q2 2011.

#4 market share: Even Dell dropped slightly to 7.2% revenue share from 8.2% last quarter.

In looking at the totals, the top four vendors represented 87.4% of the revenue share in the blade servers market which is actually down 2% from last quarter. Cisco grew revenue share by less than 1% which means that some of the displacement of the remaining top vendors is not accounted for. Does this mean there may be some new players in the “others” category that we should be watching? Without a detailed breakdown it’s hard to tell but I’ll definitely be looking forward to comparing the numbers next quarter to see if the trend continues. It could, after all, just be a factor of the margin of error in the statistics.

According to Jed Scaramella, research manager, Enterprise Servers at IDC, “Blade systems represented the fastest growing segment in the server industry and now account for 16.0% of total server revenue – a historic high.”

Probably the most interesting aspect of the report is the introduction of hyper-scale servers. “Hyper-scale servers are designed for large scale datacenters with streamlined system designs that focus on performance, energy efficiency, and density.” This sounds like the mantra for blade servers with the main difference being the lack of management and high availability capabilities at the hardware level. Basically these represent the miles of simple, rack mount commodity servers used by the likes of Google and Facebook. This is a $428 million dollar server segment and growing.

For the full IDC report covering the Q2 2011 Worldwide Server Market, please visit IDC’s website at http://www.idc.com.

Why Blade Servers Will be the Core of Future Data Centers

In 1965, Gordon Moore predicted that engineers would be able to double the number of components on a microchip every two years. Known as Moore’s law, his prediction has come true – processors are continuing to become faster each year while the components are becoming smaller and smaller. In the footprint of the original ENIAC computer, we can today fit thousands of CPUs that offer a trillion more computes per seconds at a fraction of the cost. This continued trend is allowing server manufactures to shrink the footprint of the typical x86 blade server allowing more I/O expansion, more CPUs and more memory. Will this continued trend allow blade servers to gain market share, or could it possibly be the end of rack servers? My vision of the next generation data center could answer that question.

Dell Network Daughter Card (NDC) and Network Partitioning (NPAR) Explained

If you are a reader of BladesMadeSimple, you are no stranger to Dell’s Network Daughter Card (NDC), but if it is a new term for you, let me give you the basics. Up until now, blade servers came with network interface cards (NICs) pre-installed as part of the motherboard. Most servers came standard with Dual-port 1Gb Ethernet NICs on the motherboard, so if you invested into a 10Gb Ethernet (10GbE) or other converged technologies, the onboard NICs were stuck at 1Gb Ethernet. As technology advanced and 10Gb Ethernet became more prevalent in the data center, blade servers entered the market with 10GbE standard on the motherboard. If, however, you weren’t implementing 10GbE then you found yourself paying for technology that you couldn’t use. Basically, what ever came standard on the motherboard is what you were stuck with – until now.

Why Are Dell’s Blade Servers “Different”?

I’ve learned over the years that it is very easy to focus on the feeds and speeds of a server while overlooking features that truly differentiate. When you take a look under the covers, a server’s CPU and memory are going to be equal to the competition, so the innovation that goes into the server is where the focus should be. On Dell’s community blog, Rob Bradfield, a Senior Blade Server Product Line Consultant in Dell’s Enterprise Product Group, discusses some of the innovation and reliability that goes into Dell blade servers. I encourage you to take a look at Rob’s blog post at http://dell.to/mXE7iJ. Continue reading

Comprehensive List of Blade Server Web Site Links

If you are like me, you are constantly referring to manufacture web sites for product specs, available options, etc. Today, I’ve put together a list of web sites that will help streamline your search. Since links change and new ones get added, I’ve put out a “helpful links” tab at the top of my blog as well for you to reference and bookmark. As I get recommendations from my readers, I’ll update the “helpful links” tab, so be sure to add it to your favorites. Continue reading

Cisco Finally Releases UCS Market Share Numbers

May 24, 2011 – IDC came out with their 1Q 2011 worldwide server market revenue report today showing that Cisco has finally entered the market standings with a 3rd place standing at 9.4% factory revenue share . IDC’s findings also showed that both HP and IBM decreased their blade server market share from Q4 2010. Continue reading

A Review of the Dell PowerEdge M710 HD Blade Server

Dell’s Product Marketing team recently provided me with a pair of Dell PowerEdge M710HD blade servers, so I decided to give you a review, but today I’m taking a different approach and providing you with a review via video. Since this blog is YOUR blog, let please let me know if you like this format.