I recently had a customer looking for 32 Ethernet ports on a 4 server system to drive a virtualization platform. At 8 x 1GbE per compute node, this was a typical VMware virtualization platform (they had not moved to 10GbE yet) but it’s not an easy task to perform on blade servers – however the Dell PowerEdge VRTX is an ideal platform, especially for remote locations. Continue reading

Tag Archives: Dell

IDC Reports Worldwide Blade Server Market Revenues Increase in Q4 2013

IDC came out with their Q4 2013 worldwide server market revenue report on February 27, 2014. Unfortunately I missed the announcement due to email issues, so I’ve decided to streamline things and summarize the report.

Intel E5-4600 v2 CPU Announced

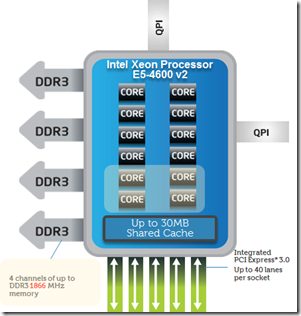

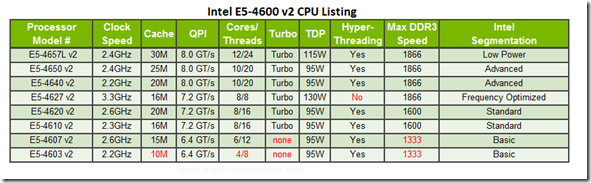

Intel announced the refresh of their 4 socket E5 line taking the CPU up to 12 cores, and 30MB of shared cache and supporting memory speeds up to 1866 MTS DDR3 DIMMs.

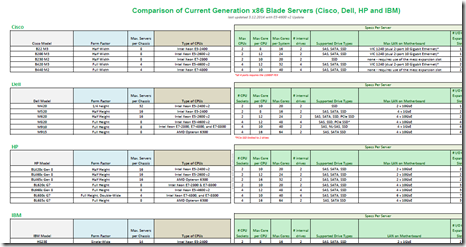

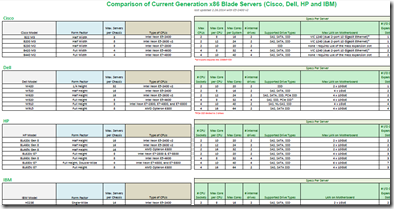

I’ve updated the current blade server comparison list to include the E5-4600 v2 offering:

Direct link to PDF (117kb): BladesMadeSimple_Blade_Server_Comparison_3.12.14

If you see anything missing or incorrect, let me know.

Kevin Houston is the founder and Editor-in-Chief of BladesMadeSimple.com. He has over 17 years of experience in the x86 server marketplace. Since 1997 Kevin has worked at several resellers in the Atlanta area, and has a vast array of competitive x86 server knowledge and certifications as well as an in-depth understanding of VMware and Citrix virtualization. Kevin works for Dell as a Server Sales Engineer covering the Global Enterprise market.

Disclaimer: The views presented in this blog are personal views and may or may not reflect any of the contributors’ employer’s positions. Furthermore, the content is not reviewed, approved or published by any employer.

Blade Server Comparisons – Feb 2014

This update includes blade servers with the Intel Xeon E5-2400 v2 CPU. I’ll add the E7 v2 once they begin shipping (and I have some data).

Link: BladesMadeSimple_BladeServer_Comparison_updated2.26.14

Kevin Houston is the founder and Editor-in-Chief of BladesMadeSimple.com. He has over 17 years of experience in the x86 server marketplace. Since 1997 Kevin has worked at several resellers in the Atlanta area, and has a vast array of competitive x86 server knowledge and certifications as well as an in-depth understanding of VMware and Citrix virtualization. Kevin works for Dell as a Server Sales Engineer covering the Global Enterprise market.

Disclaimer: The views presented in this blog are personal views and may or may not reflect any of the contributors’ employer’s positions. Furthermore, the content is not reviewed, approved or published by any employer.

Is Microsoft Planning On Releasing a Blade Server?

A recent patent search shows an application by Microsoft on December 19, 2013 for a “Tray and Chassis Blade Server” hinting that Microsoft may be ready to get into the server hardware market.

Blade Servers Preferred Over Rack Servers (Based on Q3 2013 Report by TBR)

In October, Technology Business Research (TBR) released a report titled, “Corporate IT Buying Behavior & Customer Satisfaction Study x86-based Servers” in which they discussed several topics around customer satisfaction such as Sales and Setup, Server Hardware and Service and Support. Although the report (linked below) is 109 pages, below are a couple of key topics which I found interesting.

Comparison of x86 Blade Servers

(UPDATED 11.5.2013) I often find myself seeking basic information for competitive blade servers, so I decided to sit down and put together a basic list of blade server details for Cisco, Dell, HP and IBM blade servers. The details provided are based on information publicly available and may be subject to errors. Continue reading

IDC Worldwide Server Tracker Reports Decline in Q2 2013

IDC came out with their Q2 2013 worldwide server market revenue report on August 27, 2013 which shows blade server revenues decreased 6.2% year over year to $2 billion while accounting for 16.9% of all server revenues reported. x86 server unit shipments decreased .1% year over year in 2Q13 to 1.9 million units as consolidation continued to be a strategic focus for many large and small customers around the globe.

In the blade server market, HP maintained the number 1 spot in the blade server market in 2Q13 with 44.8% revenue share; while Cisco climbed up to take sole ownership of second place with 19.6% and IBM took third place with 17.2% revenue share.

"Even though the overall blade market was down, several of the top vendors experienced positive growth within their converged and integrated system businesses. IDC finds more enterprises adopting integrated systems to increase the agility and efficiency of their IT infrastructure," said Jed Scaramella, research manager, Enterprise Servers at IDC. "Density Optimized servers achieved the highest growth of any segment in the server market. The datacenter build-outs by service providers are driving growth in the industry and represent a strategic opportunity for OEMs, while at the same time IDC is seeing new participants enter the market targeting the hyperscale datacenter segment."

In overall worldwide server systems factory revenue, IBM took top spot with 27.9% market share in Q2113. HP followed in 2nd place with 25.9% and Dell came in third with 18.8% market share.

For the full IDC report covering the Q2 2013 Worldwide Server Market, please visit IDC’s website at http://www.idc.com/getdoc.jsp?containerId=prUS24285213

Kevin Houston is the founder and Editor-in-Chief of BladesMadeSimple.com. He has over 15 years of experience in the x86 server marketplace. Since 1997 Kevin has worked at several resellers in the Atlanta area, and has a vast array of competitive x86 server knowledge and certifications as well as an in-depth understanding of VMware and Citrix virtualization. Kevin works for Dell as a Server Specialist covering the Global 500 market.

Disclaimer: The views presented in this blog are personal views and may or may not reflect any of the contributors’ employer’s positions. Furthermore, the content is not reviewed, approved or published by any employer.

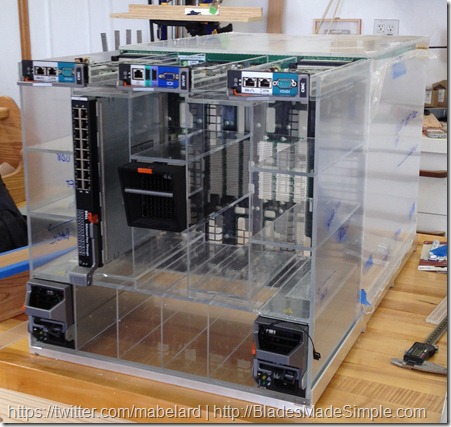

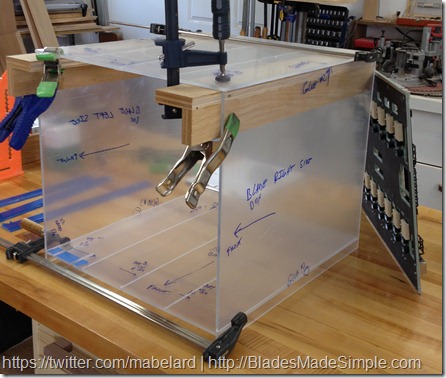

Industry’s First Ever See Through Blade Chassis

Are you one one of those people who feel that blade servers are too complex? Do you have problems understanding what’s going on inside of a blade chassis? If you said yes to either of the above questions, then you’ll want to check this blade chassis out.

One of my peers at Dell, Max Abelardo, recently created a sturdy plexiglass mock up of the Dell PowerEdge M1000e blade chassis to help demonstrate the simplicity of Dell’s blade solution. According to Max, he started pondering the idea with a buddy who is a wood worker and 3.5 weeks later it was done. Yes, this is a working mockup but probably not ideal for a datacenter. Don’t go to your nearest Dell Solutions Center looking for one of these, because you won’t find it. Max only made one and he uses it for his customers. For more details on how this was made, I encourage you to reach out to Max on Twitter at @mabelard.

Enjoy.

Kevin Houston is the founder and Editor-in-Chief of BladesMadeSimple.com. He has over 15 years of experience in the x86 server marketplace. Since 1997 Kevin has worked at several resellers in the Atlanta area, and has a vast array of competitive x86 server knowledge and certifications as well as an in-depth understanding of VMware and Citrix virtualization. Kevin works for Dell as a Server Sales Engineer covering the Global Enterprise market.

Disclaimer: The views presented in this blog are personal views and may or may not reflect any of the contributors’ employer’s positions. Furthermore, the content is not reviewed, approved or published by any employer.

IDC Worldwide Server Tracker for Q1 2013

IDC came out with their Q1 2013 worldwide server market revenue report on May 29, 2013 which shows blade server revenues decreased 2.9% year over year to $1.9 billion while accounting for 17.7% of all server revenues reported. According to the report, this is the fifth time in the previous six quarters that the server market has experienced a year-over-year decline in worldwide revenue. Server unit shipments decreased 3.9% year over year in 1Q13 to 1.9 million units as consolidation continued to be a strategic focus for many large and small customers around the globe. Continue reading